Sustainability - Identification of Materialities

We are currently surrounded by drastic changes in the social environment in which we operate, such as the impact of accelerating climate change since the industrial revolution, digitalization through technological innovation, and diversification of values and lifestyles of people.

In the midst of such social upheaval, we have depicted our ideal society of 2030 as “a resilient society where humans live in harmony with nature,” “a society that feels safe, prosperous, and exciting,” and “a society where different communities and people can coexist,” by combining Meidensha’s initial DNA of “integrity,” “responsibility,” and “social contribution,” which are our strengths, with the DNA that we must not lose of “innovative spirit” and “taking-initiative mind.” With such a mindset, the Meiden Group has set its ideal state of being for 2030, which is “sustainability partnerships that work to build a new society through integrity to the earth, society, and people, and through the power of co-creation.”

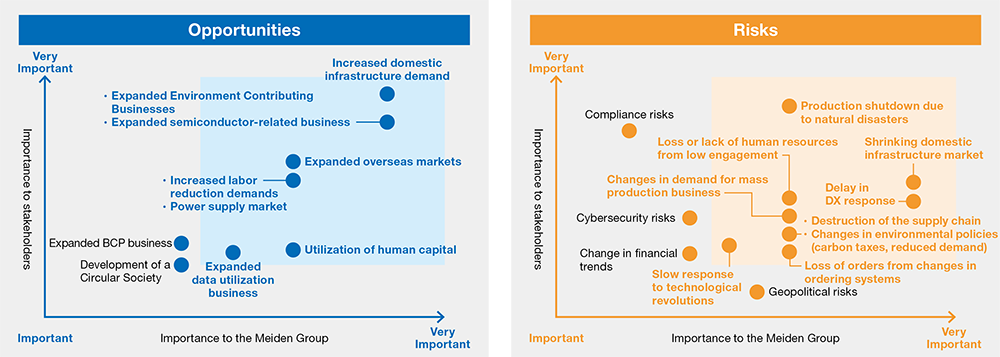

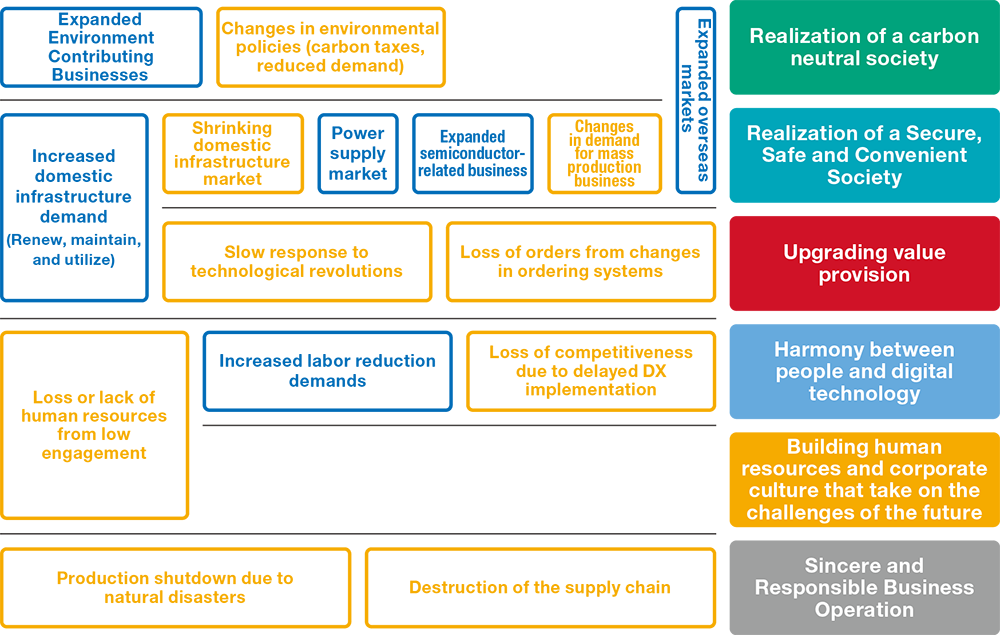

In these circumstances, in FY2021, we developed Medium-term Management Plan 2024, and identified major issues (materiality) in the plan by backcasting from our 2030 ideal state of being.

The Meiden Group will embrace the challenge of creating a new society and work toward the realization of a sustainable global environment and happiness for all people by solving materiality that has been identified.