Sustainability - Disclosure based on TCFD recommendations

For many years, the Meiden Group has been aware of the major problem of climate change, and has worked to solve this problem through business. With regard to TCFD*, we endorsed the TCFD recommendations in June 2019, we began considering risks and opportunities according to the TCFD framework in 2020, and we are promoting the incorporation of this in our strategies.

As society places more emphasis on the issue of climate change, in Medium-term Management Plan 2024, which was released in FY2021, we pledged to “promote sustainability management,” and we aim to accelerate promotion of management and development of businesses to realize a carbon-free society.

The Sustainability Management Strategy Committee and the Sustainability Management Promotion Committee handle all general matters involving sustainability and these two committees explore potential strategies to enact for decarbonization. The manager in charge of promoting sustainability and the Sustainability Management Promotion Division both report on the content of these meetings twice annually to the Board of Directors and the Executive Officers’ Meeting. Alongside these efforts and as a way of managing the promotion of environmental activities within the Group, the Meiden Group Environmental Committee, which is chaired by a production manager, meets quarterly to uncover issues within the Company, set environmental goals, devise action plans, and discuss emergency responses in order to promote and monitor the deployment of concrete policies for environmental management.

To manage sustainability-related risks, the Sustainability Management Promotion Division , which is charged with promoting sustainability management, operates centrally with relevant departments to extract risks. The details of those risks are incorporated into all the risks managed by the Governance Headquarters, which simultaneously manages a variety of risks, including those related to climate change.

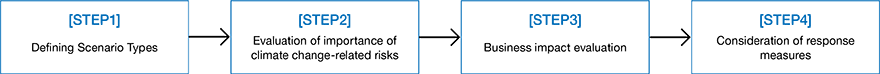

The Sustainability Management Promotion Division analyzes climate change scenarios in conjunction with relevant departments. The scenario analysis examination process is divided into four parts, with analysis and evaluations conducted annually. At the same time, major factors that could impact business are identified, and identified risks, opportunities, and evaluations are reflected in our business strategy.

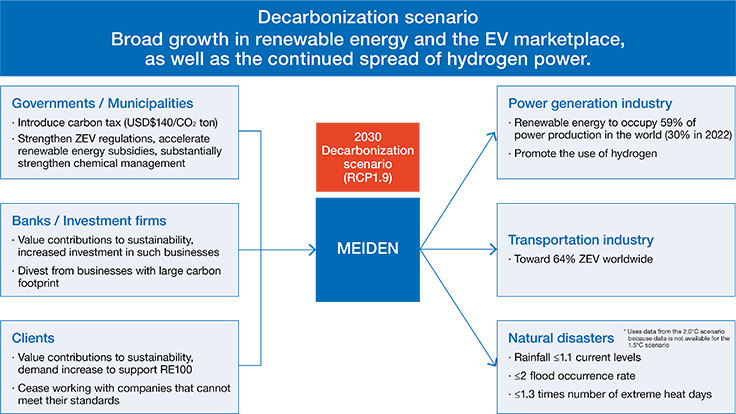

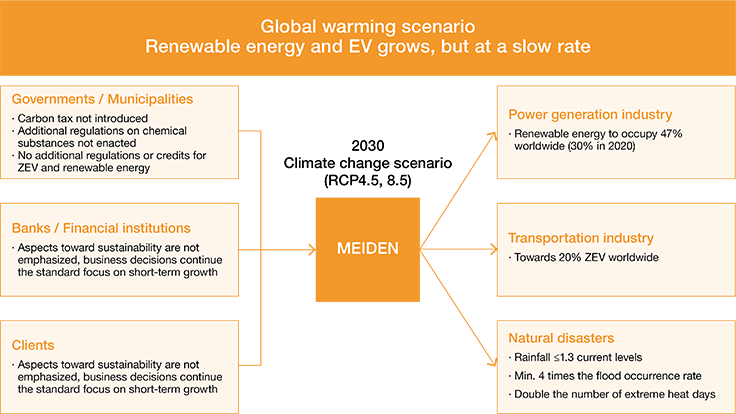

As recommended by TCFD, we identified scenarios at multiple levels of warming, including a scenario of less than 2°C, and conducted analysis accordingly. Based on the two scenarios of decarbonization (RCP1.9) and global warming (RCP4.5 and RCP8.5), we have compiled and evaluated global outlooks for 2030 to accommodate each scenario using management frameworks such as five forces analysis, based on international published data from the IEA, IPCC, etc., as well as numerical data published by Japanese government institutions, etc.

Selected scenarios and outlooks are as follows.

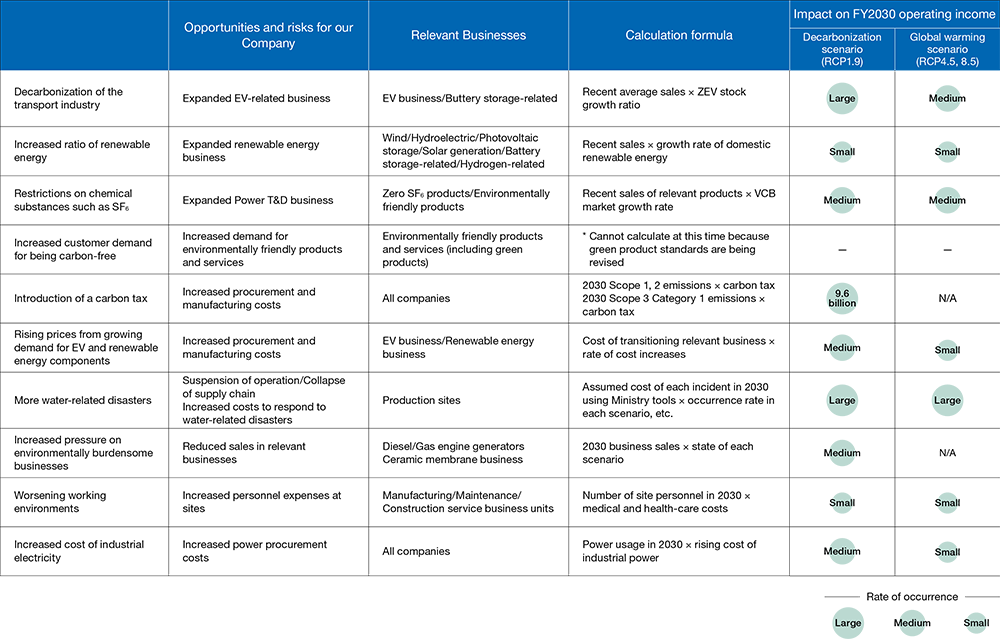

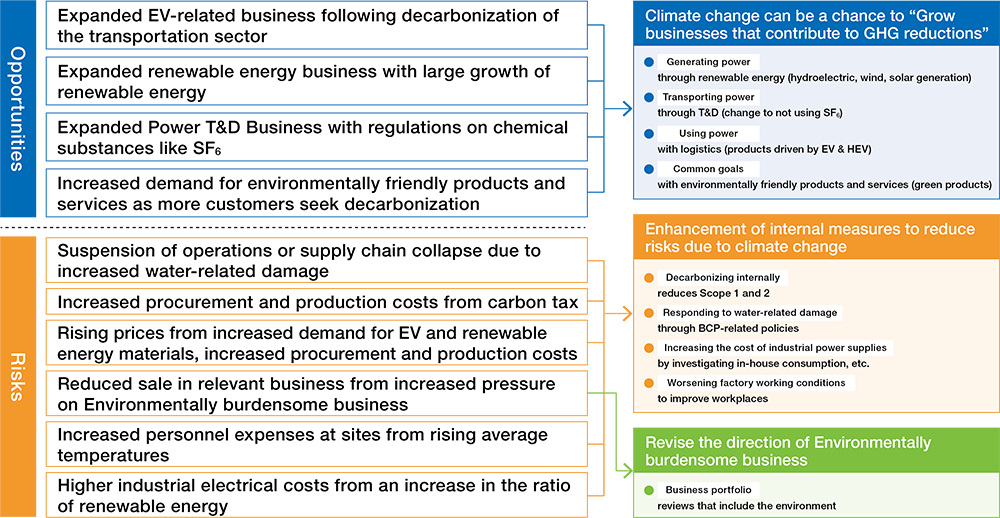

We have set out factors for climate change risks and opportunities according to the outlook of each scenario, giving reference to the risks and opportunities in the TCFD recommendations.

We are evaluating business impact through discussions with relevant parties within the Company, such as the Corporate Policy Planning Group , the Accounting & Financing Group , the Corporate Governance Management Group , and business units, based on the scenarios and outlooks set out in Step 1 and the opportunities and risks set out in Step 2.

In the course of this, we screened matters that have a particularly large impact on businesses by focusing on the two axes of “impact on operating income” and “likelihood of occurrence in an event” in FY2030, and conducted detailed analysis of these matters. We assessed pre-countermeasure outcomes based on the rate of market growth in each scenario for each large-impact item. These were quantitatively calculated using partial assumptions, and items with unachievable results were organized qualitatively.

We considered development of strategies to grasp opportunities and measures to mitigate risks according to the situation of the Company, based on the outcomes calculated in Step 3.

We see changes due to climate change as business opportunities, and are implementing strategies to mitigate risks.

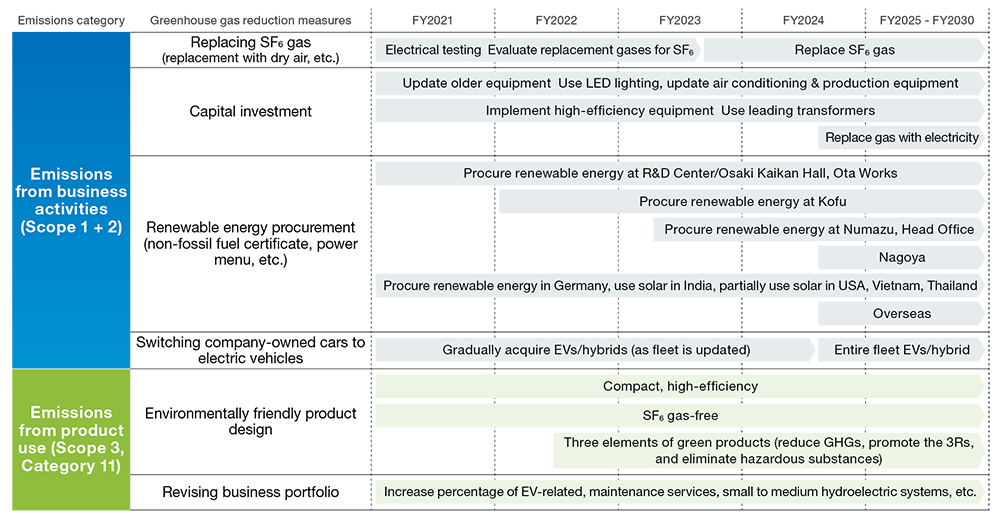

From a business perspective, we will particularly contribute to the creation of a carbon-free society through further expansion of the EV and Renewable Energy businesses. We also released the Second Meiden Environmental Vision as our environmental goals in FY2021, and we have disclosed 2030 GHG reduction targets for scopes 1, 2, and 3 in order to reduce internal risks. These goals have received SBT recognition. We will work with our suppliers to achieve our targets. In addition, we pledged to reach RE100 by 2040 and carbon neutrality by 2050, in November 2021, as our medium- to long-term targets.

Meiden Group is taking the following actions to become carbon neutral by 2050.

Although we have identified the growth opportunities and risks facing the Meiden Group through analysis of scenarios based on the TCFD recommendations, in most instances, calculation of impact is merely a rough estimate, and further precision is needed. Furthermore, we are promoting response to climate-related metric categories across multiple industries in the TCFD recommendations, which require new disclosure. Along with this, we are considering establishing ESG (environment, social, and governance) metrics, incorporating them in our standards for calculating officers’ remuneration, and further strengthening governance, in order to increase the effectiveness of sustainability management promotion.

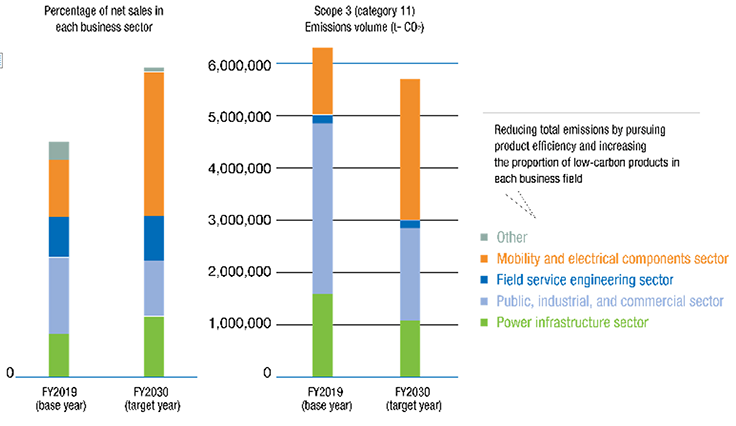

During the formulation of the Meiden Group’s FY2030 greenhouse gas emissions reduction targets, we conducted a simulation of net sales and emissions from a business portfolio revision regarding emissions in the product use stage (scope 3, category 11).

We found that by increasing the ratio of low carbon businesses with low emissions per unit of sales such as EV, maintenance services, and small and medium-sized hydropower generation, and we had a potential to comfortably achieve both increased sales and reduced emissions.

Internal carbon pricing is a mechanism that creates an economic incentive to reduce emissions and promotes investment by setting a carbon price in the company and using it to calculate the cost of greenhouse gas emissions.

Meidensha introduced an internal carbon pricing system in April 2021. We will convert carbon emissions from capital investment plans to expenses using an internal carbon price through the system. It will be a tool to make investment decisions.

Combining reductions to our environmental burden with safety and productivity considerations when making investment decisions regarding the introduction of equipment will promote the reduction of greenhouse gas emissions across our various businesses.