Sustainability - Disclosure based on TCFD recommendations

For many years, the Meiden Group has been aware of the major problem of climate change, and has worked to solve this problem through business. With regard to TCFD*, we endorsed the TCFD recommendations in June 2019, we began considering risks and opportunities according to the TCFD framework in 2020, and we are promoting the incorporation of this in our strategies.

In response to the issue of climate change as it relates to economic policies and the global situation, Meiden Group has tasked the manager in charge of promoting sustainability, an individual with superb insight honed through experience both within and outside the Group, with general implementation, while the Corporate Policy Planning Group’s Sustainability Management Promotion Division uses its expertise on environmental policy and technology to formulate and enact strategies, create countermeasures for each category, and promote monitoring.

Furthermore, the Sustainability Management Strategy Committee and the Sustainability Management Promotion Committee handle all general matters involving sustainability and these two committees explore potential strategies for decarbonization. The manager in charge of promoting sustainability and the Sustainability Management Promotion Division both report on the content of meetings twice annually to the Board of Directors, and the Board oversees the validity of plans and strategies as well as the state of implementation. Alongside these efforts and as a way of managing the progress of environmental activities within the Group, the Meiden Group Environmental Committee, which is chaired by a production manager, meets quarterly to uncover issues within the Company, set environmental goals, devise action plans, and discuss emergency responses in order to promote and monitor the deployment of concrete policies for environmental management.

To manage sustainability-related risks, the Sustainability Management Promotion Division , which is charged with promoting sustainability management, operates centrally with relevant departments to extract risks. The details of those risks are incorporated into all the risks managed by the Governance Headquarters, which simultaneously manages a variety of risks, including those related to climate change.

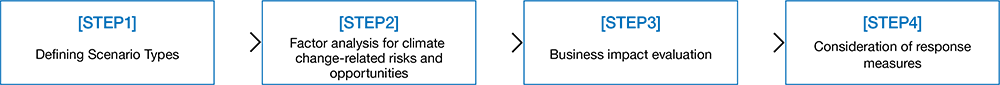

The Sustainability Management Promotion Division analyzes climate change scenarios in conjunction with the Accounting and Financing Group, the Corporate Governance Management Group, the Sales Planning & Administration Group, and other related internal groups. The examination process is divided into four parts, with analysis and evaluations conducted annually. At the same time, major factors that could impact business are identified, and identified risks, opportunities, and evaluations are reflected in our business strategy.

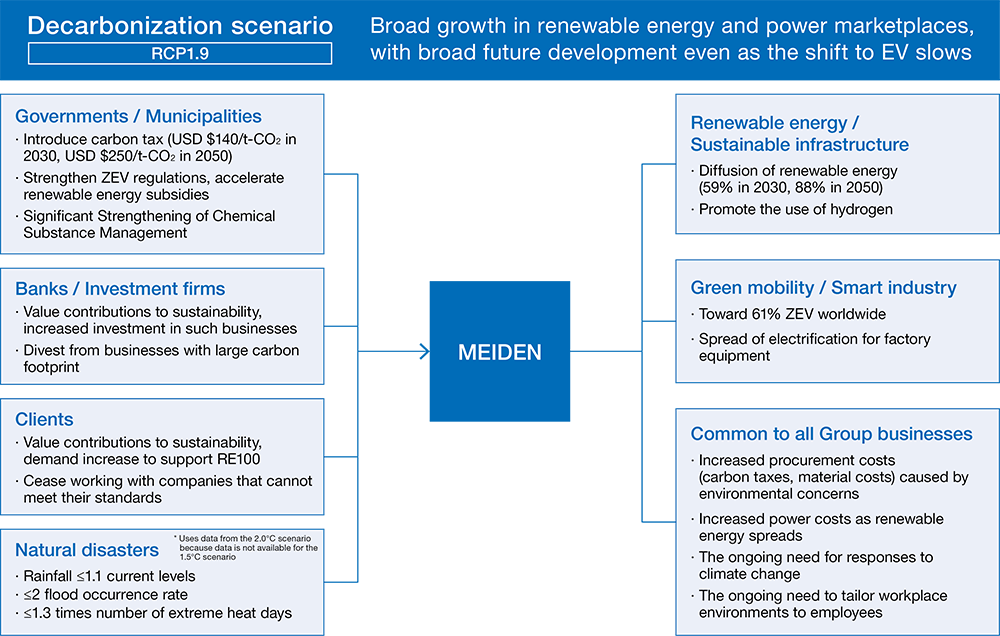

As recommended by TCFD, we selected multiple warming scenarios, including a scenario of less than 2°C, and conducted analysis accordingly. Based on the two scenarios of decarbonization (RCP1.9) and global warming (RCP4.5 and RCP8.5), we have compiled specific scenarios and global outlooks to accommodate each scenario using management frameworks, such as five forces analysis, based on internationally published data from the IEA, IPCC, etc., as well as numerical data published by Japanese government institutions, etc. We are reconstructing the global outlooks, scenarios, and numerical premises in the medium-to long-term forecasts from the current consolidated fiscal year through to 2050, the final fiscal year of the Meiden Group’s long-term environmental targets.

Selected scenarios and outlooks are as follows.

We identified risk and opportunity factors associated with climate change based on global outlooks for each scenario, while also referring to the risk and opportunities listed in the TCFD recommendations, then separated them by relevant scope both by business domain and for the Meiden Group as a whole before setting out timelines for specific risks and opportunities and the effects they will generate.

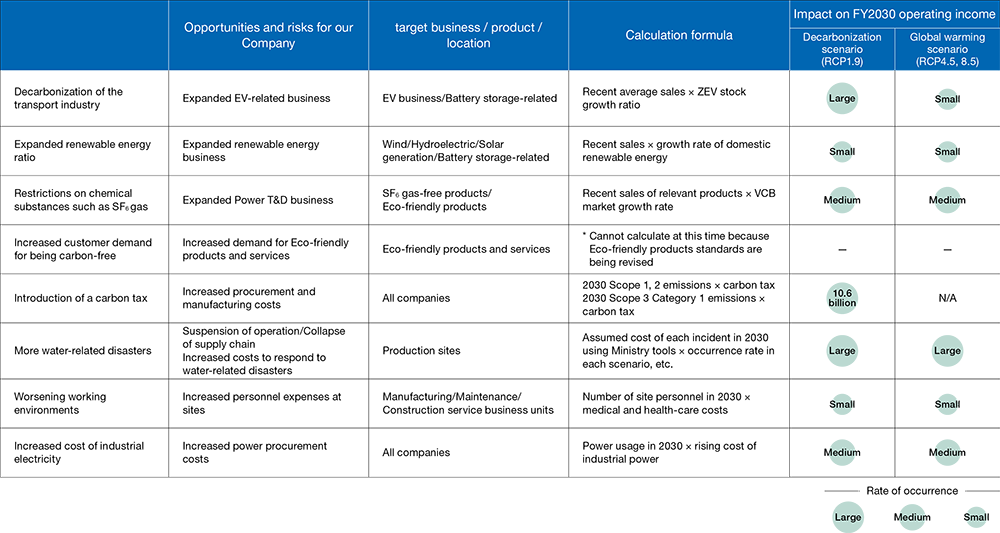

We evaluated the impact on business based on the global outlooks for each scenario set out in Step 1 and the opportunities and risks defined in Step 2. During this process, we screened for matters with a particularly large impact on businesses by focusing on the two axes of “impact on operating income” and “likelihood of occurrence in an event” that are the target of the FY2030 milestones set out in the Third Meiden Environmental Vision, and then conducted detailed analyses of these matters. We assessed market order values (values before countermeasure involvement) based on the rate of market growth in each scenario for each large-impact item. These were quantitatively calculated using partial assumptions, and items with unachievable calculations were organized qualitatively.

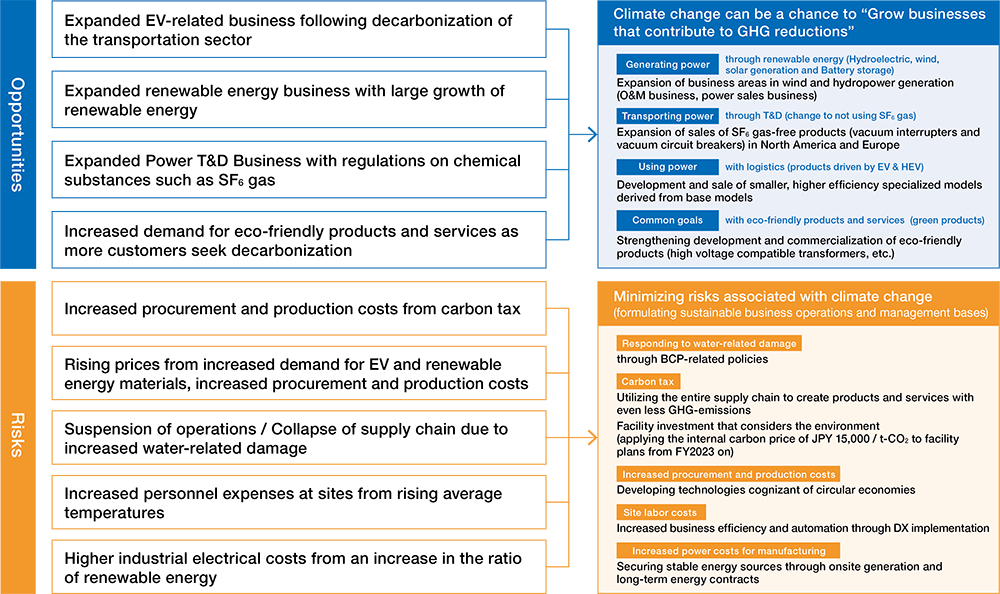

Based on the market order values calculated in Step 3, we considered strategies to grasp opportunities and measures to mitigate risks according to the Company’s situation.

As decarbonization-related markets grow and we look ahead to responses to regulations in Japan and abroad, we acquired SuMPO EPD*2 certification (formerly Ecoleaf) for our ester oil*1 transformers under the Sustainable Management Promotion Organization (SuMPO) environmental labeling program. The Meiden Group is the first in our industry to receive this certification.

The SuMPO EPD label is a certification system that discloses information on a product’s environmental burden throughout its entire lifecycle, from sourcing material to manufacturing, distribution, and use, through to disposal and/or recycling. We received this certification for the multifaceted evaluation on the environmental impact of our ester oil transformers that extends beyond visualizations of GHG emission levels in the product lifecycle to include information on factors such as resource circulation and its effect on air and water.

Visualizing GHG emissions will contribute to increasing the accuracy of customer Scope 3 emission calculations while also singling out areas for improvements in decreasing emissions across their entire supply chain. That will help our customers decarbonize while allowing us to respond to stakeholder disclosure requests with highly transparent ESG information.

As the world transitions to a carbon neutral society by 2050, we anticipate that environmentally conscious products will command a more domineering position in the marketplace. Acquisition of this stringent EPD third-party certification will certify this product line’s environmental performance from an objective standpoint while simultaneously providing a response to environmental regulations.

Moving forward, the Meiden Group will continue to develop and provide products with even greater environmental consciousness that help create a sustainable society.

Expanding the SF6 gas-free switchgear business that can contribute to a decarbonized society is one climate-change related opportunity for the Meiden Group.

A vital component in power infrastructure, switchgears have traditionally relied on SF6 gas to interrupt and isolate currents. However, SF6 gas has 20,000 times the global warming effect of CO2, so the Meiden Group has developed eco-friendly switchgears that eliminate SF6 gas completely by using vacuum interrupters to interrupt current, and dry air for the isolating gas. In 2007, we released a 72-kV-class tank type vacuum circuit breaker (dry air isolation) to markets around the globe, and then in 2020, developed the world’s first 145-kV-class model to meet high-voltage requirements. That same year, we also founded Meiden America Switchgear, Inc. (hereafter Meiden America Switchgear), the first North American base to handle SF6 gas-free switchgear, which is thriving in the current business environment and represents one area of continued growth.

Looking toward the future, we anticipate that the introduction of the EU’s restrictions on SF6 gas in 2026 and other similar measures will vastly increase the demand for decarbonizing power equipment in the power industry. The Meiden Group cannot let such a wonderful opportunity pass as we grow out business to become the world’s leading vacuum circuit breaker manufacturer.

Particularly since it pertains to the Medium-term Management Plan 2027, we will continue to introduce our evolving line of eco-friendly switchgears to global markets, while increasing the production capacity of Meiden America Switchgear. As we do so, we will also develop switchgear products that can provide even higher voltages and larger capacities as initiatives for the future, in preparation for our expanded presence in European markets following the enactment of SF6 gas regulations.

Moving forward, Meiden Group will continue to develop and release eco-friendly products and services like these in order to capitalize on business growth opportunities that accompany environmental changes.

In November 2021, the Medien Group pledged to reach RE100 by 2040 and carbon neutrality by 2050 as our long-term targets. In FY2021, we also released the Second Meiden Environmental Vision with upwardly revised GHG emission reduction targets for scopes 1, 2, and 3 by FY2030 as medium-term targets. We then formulated the Third Meiden Environmental Vision with new targets that correspond to the 1.5℃ scenario as part of Medium-term Management Plan 2027 that began in FY2025 and also set targets for FY2027, the final year of the Medium-term Management Plan, as short-term targets. To date, our Scope 3 reduction targets have been applied to reduction targets for Category 11 “use of sold products,” the category with the highest emission levels, but the Third Meiden Environmental Vision set new reduction targets for all categories. Additionally, these targets were certified by the SBT (Science Based Targets) initiative in March 2025.

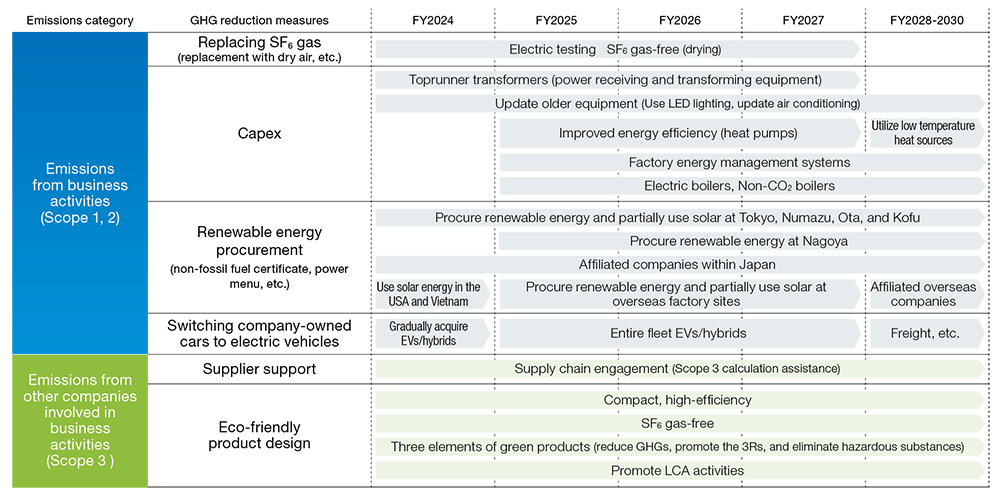

Meiden Group is taking the following actions to become carbon neutral by 2050.

Although we have identified the growth opportunities and risks facing the Meiden Group through analysis of scenarios based on the TCFD recommendations, in most instances, calculation of impact is merely a rough estimate, and further precision is needed. Furthermore, we are promoting response to climate-related metric categories across multiple industries in the TCFD recommendations, which require new disclosure. We have also incorporated some sustainability-related indicators into the evaluation standards for determining director compensation (except Audit and Supervisory Committee Members and outside directors) and are currently exploring integrating environmental indicators into future incentive packages in order to increase the effectiveness of advancing sustainability management.