Sustainability - Corporate Governance

Under our Corporate Mission of “illuminating a more affluent tomorrow” and our Corporate Philosophy of providing value“ for customer peace of mind and satisfaction,” our group has set forth our Ideal State of Being/Vision for 2030 as “Work to build a new society through integrity to the earth, society, and people, and through the power of co-creation – Sustainability Partner –.”Our group takes the basic stance that we maintain fair and steady business activities with respect for people and the global environment, operate businesses focusing on profit while constantly pursuing new technology and high quality, and endeavor to give back to society.

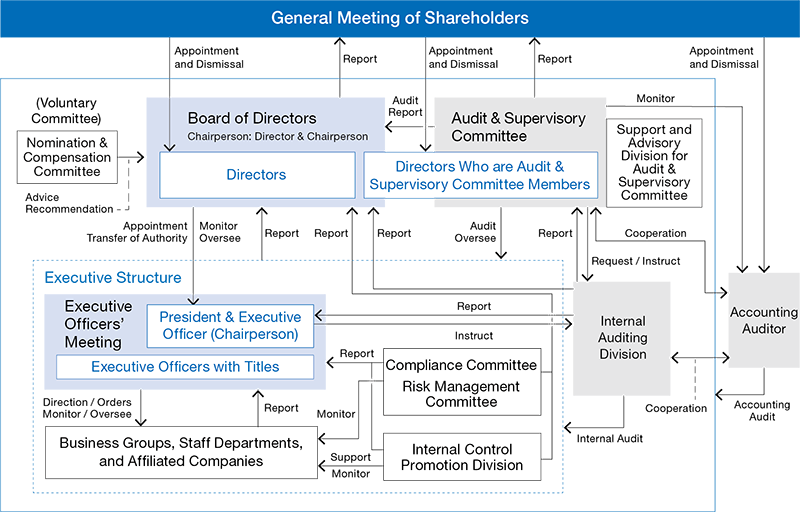

In order to implement this basic stance, we formulated the “Basic Policy to Improve the Governance to Secure Fair Business Practices” at the regular Board of Directors meeting held in May 2006. In addition, we revised this basic policy at the regular Board of Directors meeting held in July 2022, as a result of a revision of the officer system to further clarify the division of roles between executive functions (executive officers) and so-called supervisory functions (directors and the Board of Directors).

We will work to further improve the fairness, efficiency, and transparency of management by promoting initiatives to enhance corporate governance in accordance with the Corporate Governance Code.

Meidensha will work to further improve the fairness, efficiency, and transparency of management by promoting initiatives to enhance corporate governance in accordance with the Corporate Governance Code.

We will work to establish an environment where shareholders can exercise their rights appropriately and we will actively disclose information to this end, thereby ensuring shareholder rights and equality.

In order to achieve the Meiden Group’s sustainable growth and enhance its corporate value over the medium to long term, we will disclose appropriate information and engage in dialogue with our various stakeholders, including customers, suppliers, and members of the local community.

We will make timely disclosures of information in accordance with laws and regulations and will also disclose information on the status of our company, including non-financial information, in a timely and appropriate manner through media that are widely accessible to stakeholders (our websites, integrated reports, and other publications).

Based on the Meiden Group Corporate Philosophy, the Board of Directors will formulate medium- to long-term management plans and strive to enhance the medium- to long-term corporate value of our Group by making decisions and supervising business execution in the implementation of these plans.

As a company with an Audit & Supervisory Committee, we strive to improve the supervisory function of the Board of Directors. In addition, we will further promote separation of supervisory and executive functions by utilizing the executive officer system, which was introduced in June 2003 and revised to enhance its legitimacy in June 2022 to form a system wherein the Board of Directors’ resolutions on executive officer appointments are grounded in the Articles of Incorporation.

Our policy is to ensure that senior management respond within reason, when engaging in dialogue with shareholders who wish to create that dialogue to help enhance our corporate value over the medium to long term.

In addition, as a prerequisite for this dialogue, we will endeavor to provide more opportunities for various briefings and IR/SR interviews and offer enhanced information disclosure through our websites, integrated reports, and other publications.

We are a company with an Audit & Supervisory Committee, and we aim to further strengthen corporate governance in the following areas.

In principle, the Board of Directors convenes on a regular monthly basis and holds ad-hoc meetings as necessary, to discuss major executive matters, business issues, and management issues related to our business execution. In FY2024, the Board of Directors held 13 meetings, and the attendance rate was 100% for all directors.

The specific composition of the Board of Directors and meeting attendance in FY2024 are described below in “Composition of the Board of Directors, Nomination & Compensation Committee, and Audit & Supervisory Committee and Attendance in FY2024” below.

To ensure sufficient discussion of management issues, the number of directors is stipulated to be no more than 15 (10 directors who are not Audit & Supervisory Committee members and 5 directors who are Audit & Supervisory Committee members).

Our Board of Directors consists of 10 directors, including 4 who are Audit & Supervisory Committee members. The 10 directors also include 6 outside directors (of which 3 are members of the Audit & Supervisory Committee), all of whom satisfy our criteria for determining the independence of outside directors and the requirements for independent directors as defined by the Tokyo Stock Exchange. This means that independent outside directors make up a majority of the Board of Directors, ensuring the effectiveness of the supervisory functions of the Board of Directors and that objective and independent opinions are fully incorporated into the company’s management.

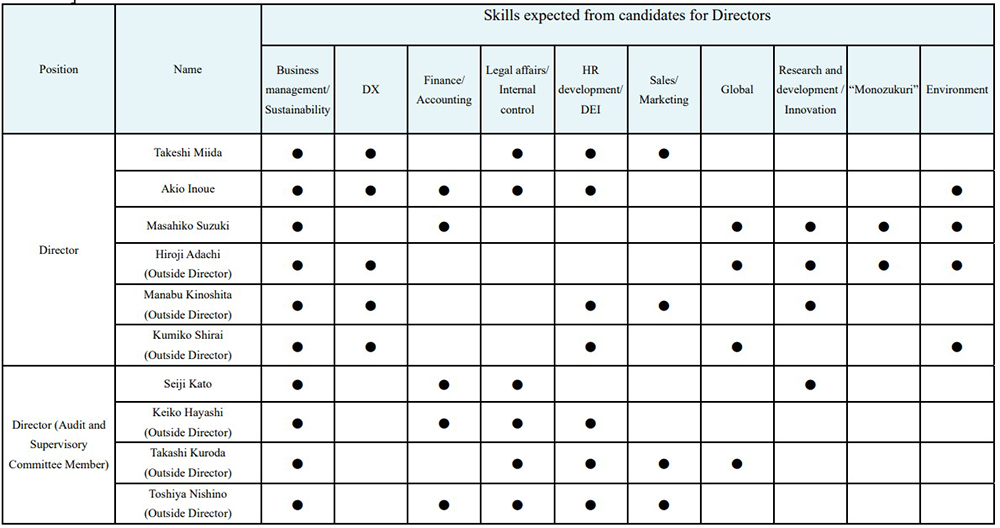

Regarding the appointment of directors, it is the basic policy to ensure the diversity of the Board of Directors as a whole based on the abilities, insight, and experience of individual directors and to assign appropriate human resources that contribute to the enhancement of our corporate value. It is also our policy to ensure the diversity and balance of the Audit & Supervisory Committee as a whole based on the knowledge and experience of accounting, financial, and legal matters etc., of directors who are members of the Audit & Supervisory Committee. The balance of expertise, knowledge, experience, etc., is as described in the Board of Directors’ Skill Matrix below.

The matters handled by our Board of Directors comprise items for resolution, items to be reported, setting agendas for Board of Directors’ meetings, matters for cooperative discussion involving performance evaluations, and Board operations. The Board actively exchanges opinions on matters involving the company’s management issues, strategies, and corporate governance while drawing on the knowledge of the outside directors to execute its supervisory functions. Meidensha held irregular “On-site Meetings” consisting of all directors (nine meetings in FY2024). Created in FY2023, these meetings let directors fluidly exchange opinions and discuss issues, strategies, and other matters important to the company that impact management in the early stages. Matters discussed in On-site Meetings are reflected in the execution of business on the executive side and link to decisions and reports from the Board of Directors.

Major topics discussed by the Board of Directors in FY2024 included the following.

Our outside directors review materials provided to them roughly 5 business days prior to a Board of Directors meeting and attend a briefing held roughly 3 business days prior to the meeting to develop an understanding of the matters submitted for discussion, with explanations from the Executive Vice President and selected executive officers to gain an understanding of each issue from various perspectives and check any unclear points in advance of the meeting. Notably, as a prerequisite for the monitoring and supervisory functions of the Board of Directors, materials for important meetings such as the Executive Officers’ Meeting and other important committee meetings provided by the Secretariat of the Board of Directors are checked as needed.

At Board of Directors’ Meetings, multifaceted discussion occurs, based on the broad perspective of managers, the knowledge of technicians, and the high-level specialization of experts, etc. The outside directors participate in deliberations by actively making statements, etc., in particular concerning policies and measures to deal with risks, and cautions when monitoring, etc.

We create opportunities to explain our business and structures, primarily to aid the understanding of newly appointed outside directors. The responsible officers or managers in charge of the business group explain their business, group-wide themes, and our governance system to the outside directors, answer their questions, and exchange opinions with them.

Meidensha has a mechanism in place to conduct an analysis and evaluation of the effectiveness of the Board of Directors in order to strengthen the supervisory function of the Board of Directors.

With regard to the activities of the Board of Directors in FY2024, all members of the Board of Directors (including outside directors) evaluated the effectiveness of the Board of Directors (including self-evaluations), and the following discussions took place at meetings of the Board of Directors, in order to revitalize deliberations by the Board of Directors.

An overview of the analysis, evaluation, and discussions is as follows.

Based on the above, we will continue working to increase the effectiveness of the Board of Directors.

Meidensha has established a voluntary Nomination & Compensation Committee as an advisory body to the Board of Directors. Its purpose is to ensure management transparency and strengthen accountability regarding nominations (appointments and dismissals) and compensation of directors.

The specific composition of the Nomination & Compensation Committee and meeting attendance in FY2024 are described in “Composition of the Board of Directors, Nomination & Compensation Committee, and Audit & Supervisory Committee and Attendance in FY2024” above.

Based on the basic policy for ensuring a balance between the diversity of the Board of Directors as a whole and its expertise and experience, as described in (1) ① Composition of Board of Directors above, we select individuals who will help strengthen the decision-making and supervisory functions of the Board of Directors. The Board of Directors consults with the Nomination & Compensation Committee (a voluntary committee), with independent outside directors as the main members and chair, then the Board of Directors nominates candidates by resolution. Finally, nominations are submitted to the General Meeting of Shareholders.

In the event that a director is found to be in violation of laws and regulations or the Articles of Incorporation, or to have significantly deviated from the policy for the appointment of directors, the Board of Directors will take the necessary procedures for dismissal after consulting with the Nomination & Compensation Committee.

Meidensha believes that members of the Board of Directors should have such skills and experiences by the reasons below.

Meidensha formulates a successor plan for the CEO and selects multiple potential successors that satisfy certain requirements from the pool of directors and executive officers with titles. Because selected candidates must cultivate the requisite qualifications and skills to create sustainable growth and increase corporate value, we conduct continuous candidate monitoring and formulate growth plans through opportunities to accumulate diverse experiences, interviews with outside directors, and more. Additionally, CEO selection employs a transparent process where candidates are designated in consultation with the Nomination & Compensation Committee, then the Executive Officers’ Meeting and the Board of Directors review each candidate and select the successor.

Meidensha introduced an executive officer system in June 2003 in order to streamline the Board of Directors, as well as to accelerate management decision-making and to enhance supervisory functions. At the same time, we sought to reinforce the functions of the Board of Directors by promoting the separation of the decision-making authority and supervisory function from the business performance function held by the Board of Directors.

Based on the Articles of Incorporation, executive officers selected by the Board of Director’s Meeting assume responsibility for the execution of specified tasks within the scope of authority transferred by the Executive Officers’ Meeting and the President and Executive Officer, and nimbly perform executive functions under the supervision of the Board of Directors, in accordance with the Meiden Group’s management policies determined by the Board of Directors.

The Executive Officers’ Meeting, which comprises Executive Officers with Titles, is created for executive decision-making, and decides matters based on the rules of internal approval, as well as matters for which consultation from a full-company perspective is required.

Furthermore, apart from the meeting body to make decisions, we established review meetings and strategy meetings to serve as advisory and internal bodies, and with regard to important management matters, we created a system wherein thorough discussion and deliberation are conducted prior to decision-making, and follow-up strategy and planning and improvement initiatives are conducted following decision-making.

Summaries and key points of proceedings at the Executive Officers’ Meeting and other internal bodies are reported at the regular meeting of the Board of Directors for the month as a report on business execution. This helps to ensure and improve the effectiveness and supervisory functions of the Board of Directors.

Decisions on business execution matters not submitted to the Executive Officers’ Meeting for discussion are made by executive officers who have authority over business execution and strive to execute operations proactively and flexibly.

In addition, the Board of Directors delegates part of its business execution authority to executive officers via the directors, and the executive officers are required to submit a report on the status of business execution to the Board of Directors at least once every 3 months, which helps ensure that the Board of Directors can supervise effectively.

Our Audit & Supervisory Committee consists of 4 directors who are Audit & Supervisory Committee members (including 3 outside directors and 1 full-time inside director).

The Audit & Supervisory Committee audits the directors’ execution of duties and confirms from a fair, unbiased, and objective standpoint the basic policy regarding the development of internal control systems and the status of their development and operation. Attendance at meetings of the Audit & Supervisory Committee and the like by each member are described in the aforementioned “Composition of the Board of Directors, Nomination & Compensation Committee, and Audit & Supervisory Committee and Attendance in FY2024.”

As a general rule, the Audit & Supervisory Committee is held once a month prior to the Board of Directors' Meeting. This is to enable the Audit & Supervisory Committee to form its positions on matters to be discussed at the Board of Directors' Meeting before the meeting is held. In case there is a quarterly audit report from the accounting auditor, the Audit & Supervisory Committee is held twice a month. In FY2024, each meeting lasted an average of roughly 90 minutes, and there were 73 agenda items for the year.

In addition, we established the Support and Advisory Division for Audit & Supervisory Committee exclusively to aid the Audit & Supervisory Committee. It has 5 members with HR and general affairs, legal, intellectual property, finance, sales, production engineering, factory, quality assurance, overseas business planning, and internal auditing experience (as of March 31, 2025).

Meidensha has established the Internal Auditing Division (16 members as of March 31, 2025).

As an organization under the direct control of the President and Executive Officer, the Internal Auditing Division is independent from other executive lines. It conducts internal audits to check the effectiveness and efficiency of business operations, the reliability of financial reporting, the status of compliance with laws and regulations, and the maintenance of assets, covering Meidensha and all Meiden Group companies in Japan and overseas. After conducting these audits, the division follows up with the audited departments in writing or in person to improve the effectiveness of internal audits.

In addition, the division comprises individuals with diverse experience in business and promotes initiatives that strengthen systems such as advocating that individuals obtain qualifications, starting with internal auditor certification.

Regarding relationships with internal control divisions, the Internal Control Promotion Division which is a specialized division establishes risk management systems that integrate the entire Meiden Group and promotes enhancement of internal control systems, the Audit & Supervisory Committee and Internal Auditing Division monitor internal control systems, and the Internal Control Promotion Division, Audit & Supervisory Committee, and Internal Auditing Division work together to enhance the effectiveness of internal control.

In FY2024, the internal audits were mainly conducted by 2 methods.

At Meidensha, the company-wide risks confirmed by the Risk Management Committee were reassessed from the perspectives of the Internal Auditing Division, and risk-based audits targeting the highest-priority risk areas were conducted in 14 divisions selected based on risk factors focused on by management and other risks.

We standardize audits in subsidiaries using audit standardization tools that improve audit standards in order to ensure risk comprehensiveness.

In FY2024, we applied these standards to seven domestic subsidiaries and eight overseas subsidiaries, and have conducted an audit of every subsidiary between FY2021 and FY2024.

The Internal Audit Regulations stipulate that internal audit results are to be reported to the President & Executive Officer, the Board of Directors, the Executive Officers’ Meeting, and the Audit & Supervisory Committee.

In FY2024, reports were presented monthly to the President & Executive Officer, semiannually to the Board of Directors and the Executive Officers’ Meeting, and 11 times to the Audit & Supervisory Committee. Internal audit reports are also sent to the members of the Executive Officers’ Meeting and standing Audit & Supervisory Committee members each time one is issued.

The Meiden Group is working to continuously strengthen group governance by developing basic policies based on the “Basic Policy regarding Establishment of a System to Ensure the Appropriateness of Business Activities” at each Meiden Group company, establishing a regulatory framework, and implementing the PDCA cycle.

1. Major Initiatives in FY2024

The Group Company Internal Control Committee is held twice a year to share with domestic subsidiaries information on important top risks for the Meiden Group as discussed by the Risk Management Committee for domestic subsidiaries and the progress of risk management at each company. In addition, by verifying and reviewing the consistency between the company’s decision-making policies and those of each related company, we maintain the division of roles in business group controls and the scope of responsibility between each division.

Furthermore, to strengthen internal control throughout the Meiden Group, we conducted internal audits of 7 domestic subsidiaries and 8 overseas subsidiaries to confirm the status of internal control development and operation, and visited 2 overseas subsidiaries to foster a common understanding of the importance and challenges of strengthening governance and compliance.

Additionally, new subsidiary CEOs receive training to obtain perspective as a director in order to improve the effectiveness of management and supervisory functions and strengthen the subsidiary’s Board of Directors.

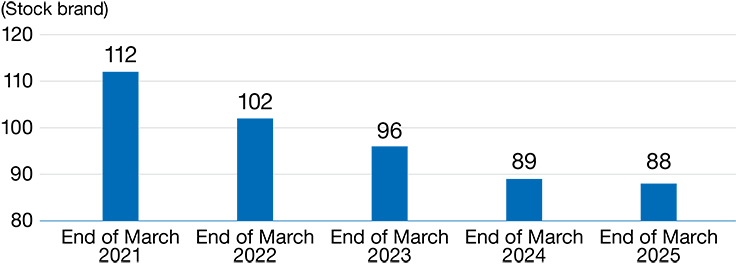

Our basic policy is to hold cross-shareholdings that contribute to enhancing our corporate value and consider selling those that no longer seem reasonable to own for the purpose to maintain and expand transactions and to secure and strengthen medium- to long-term cooperative relationships with partners and fellow alliance members, taking account of market conditions and other factors.

Under this policy, we decide in an annual Board of Directors’ meeting to keep or reduce its current holdings of listed stocks based on a comprehensive assessment of whether the ratio of each stock’s return (dividends, related trading profits, etc.) to market value meets the target cost of capital, policy factors, and so on.

In FY2024, of the 89 listed and unlisted stocks held as of March 31, 2024 (balance sheet amount: 26,280 million yen), we sold our entire holdings of one listed stock, decreased one unlisted stock due to dissolution, and increased one listed stock through a new acquisition via membership in a golf club, resulting in the number of stocks held to 88 as of March 31, 2025 and a decrease in our balance sheet amount to 23,221 million yen. This represents 16.3% of consolidated net assets as of March 31, 2025. Additionally, the company does not hold any deemed shares.

Based on the basic policy mentioned above, in FY2025, we will review cross-shareholdings and advance appropriate responses while staying cognizant of securing resources for continued value creation connected to the growth strategies and investment strategies detailed in Medium-term Management Plan 2027.

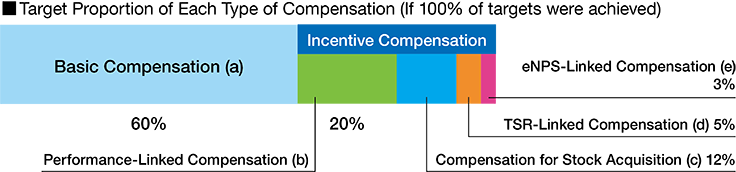

The level of compensation of Meidensha’s directors is determined based on external objective compensation market data, economic conditions, industry trends, and Meidensha’s business circumstances, etc. Giving consideration to this level, the content of the director’s compensation system is determined in the form of internal regulations on director’s compensation after consultation and confirmation by the aforementioned voluntary Nomination & Compensation Committee, chaired by an outside director.

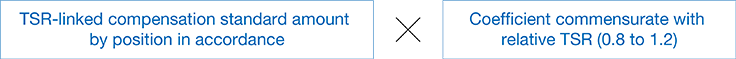

Compensation of directors (excluding Audit & Supervisory Committee members and outside directors) is based on an annual salary system with performance-linked compensation and comprises basic compensation (a) and incentive compensation according to position. Of these, incentive compensation comprises performance-linked compensation (b) as a short-term incentive and compensation for stock acquisition (c), TSR (total shareholder return)-linked compensation (d), and eNPS-linked compensation (e)* as medium- to long-term incentives.

Directors and outside directors who are Audit & Supervisory Committee members only receive basic compensation on annual salary system basis.。

The performance indicator for calculating performance-linked compensation as a short-term incentive is decided after the annual general meeting of shareholders for the relevant fiscal year. It is decided based on the operating income of the previous fiscal year to raise awareness of the need to improve performance, especially profitability, each fiscal year. The performance-linked compensation indicator varies from 0 to 140 depending on the degree to which targets were achieved, with perfect achievement counting as 100.

Operating income for FY2023 was 12.731 billion yen compared to the target of 10 billion yen, which represents an achievement rate of 127%.

Meidensha provides compensation for stock acquisition, TSR (total shareholder return)-linked compensation, and eNPS (Employee Net Promoter Score)-linked compensation as medium- to long-term incentives to sustainably increase corporate value and further promote the alignment of interests among directors (excluding Audit & Supervisory Committee members and outside directors) and shareholders.

Details of the compensation system and the amount of compensation (including the rules that it is calculated in accordance with the standards of the compensation system and is within the compensation limits decided at the General Meeting of Shareholders) are confirmed and deliberated from an objective point of view by the voluntary Nomination & Compensation Committee.

Specific details of the amount of compensation for each individual director (excluding Audit & Supervisory Committee members. Hereinafter the same shall apply in this section.) are delegated to the President & Executive Officer (the “President”), who is a director, based on a resolution of the Board of Directors. The reason for this delegation is that, as the person with the highest responsibility for the execution of Meidensha’s business operations, the President is best suited to evaluate each director while maintaining a bird’s-eye view of Meidensha’s overall performance. To ensure that the President exercises this authority properly, the Board of Directors establishes procedures for the President to consult and obtain confirmation of the draft in advance from the voluntary Nomination & Compensation Committee. Moreover, the President’s decision on the details of individual compensation for each director must consider the details of such confirmation or report, and the Board of Directors has also respected such reports and determined that the details of compensation for each individual director (excluding Audit & Supervisory Committee members) are in line with the decision-making policy.

Compensation for directors who are members of the Audit & Supervisory Committee is determined by the same committee within the compensation limit decided at the General Meeting of Shareholders. An appropriate amount is set to reward the services of committee members, taking into consideration whether they are standing or non-standing and the nature of their respective auditing duties.